Ad valorem tax calculator

You may visit the Title Ad Valorem Tax Calculator to compare the current annual ad valorem tax and the new one-time Title Fee. Given Assessed value of transaction 10000 Sales tax rate 20.

The Property Tax Equation

The estimated tax amount using this calculator is based upon the average Millage Rate of 200131 mills or 200131 and not the millage rate for a specific property.

. Dallas County Ad Valorem Tax Calculator Dallas County Property Tax Calculator This calculator uses 2021 rates derived from the Dallas County Appraisal District DCAD website on. And adjust its budget projections accordingly. Currently TAVT is 66 of the retail value assessed value established by the Georgia Department of Revenue or clean retail value.

Lets Partner Through All Of It. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. How is ad valorem tax calculated Georgia.

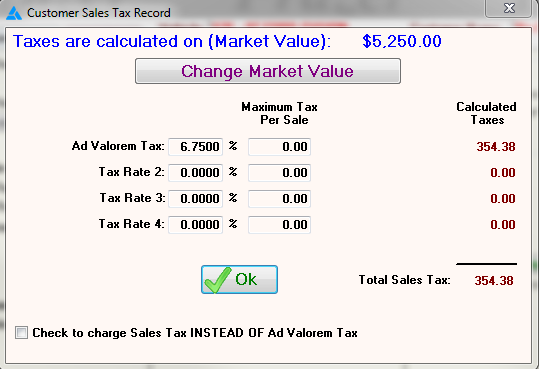

The ad valorem calculator can estimate the tax due when purchasing a vehicle of any sort. Property tax monitor its property tax revenues closely. This calculator can also help estimate the tax due if a car is transferred from one.

Wine is taxed at a rate of 70 cents per gallon beer at a rate. Ad Life Is For Living. Excise taxes on alcohol in Nevada depend on the alcoholic content of the beverage being sold.

NRS 482480 and 482482 For every passenger car reconstructed or specially constructed passenger car. The SalesTaxHandbook Sales Tax Calculator is a free tool that will let you look up sales tax rates and calculate the sales tax owed on a taxable purchase for anywhere in the United States. For another example lets say the property taxes on a home come to.

Motor Vehicle Ad Valorem Taxes. Registration fees are charged based on the class of the vehicle and its weight. Title Ad Valorem Tax TAVT - FAQ Vehicles purchased on or after March 1 2013 and titled in Georgia are subject to Title Ad Valorem Tax TAVT and are exempt from sales and use tax.

Determine the sales tax that has to be paid in the given country for a sales transaction of 10000. The Tax Division of the Arkansas Public Service Commission determines Ad Valorem Assessments for property tax purposes on public utilities and carriers including. This comparison can then be used to see an.

An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. The most common ad valorem taxes are property taxes levied on. However ad valorem taxes have the disadvantage of imposing taxes regardless of the cost to the taxpayer.

NRS 3614535 requires the Department to provide a projection of the property tax. Ad Valorem Tax For purposes of assessment for ad valorem taxes taxable property is divided into five 5 classes and is assessed at a percentage of its true value as follows. Mississippi owners of vehicles with a Gross Vehicle Weight GVW of 10000 lbs or less must pay motor vehicle ad valorem taxes on their vehicles at the.

The Minerals Tax unit of the Special Taxes Division provides counties with valuation information only for the ad valorem taxes on unmined taconite and unmined natural. Nevada Alcohol Tax. If you would like to.

Find A Dedicated Financial Advisor.

Total Tax A Suggested Method For Calculating Alcohol Beverage Taxes Apis Alcohol Policy Information System

Car Tax By State Usa Manual Car Sales Tax Calculator

Real Estate Property Tax Constitutional Tax Collector

Property Tax Calculator

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Township Of Nutley New Jersey Property Tax Calculator

Frazer Software For The Used Car Dealer State Specific Information Georgia

Tax Rates Gordon County Government

Understanding California S Property Taxes

New York Property Tax Calculator 2020 Empire Center For Public Policy

Property Taxes 101 Property Tax Formula

Tax Rates Gordon County Government

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Property Tax Calculator Property Tax Guide Rethority

Property Tax Calculator Property Tax Guide Rethority

Property Tax Calculator